nairaandkobo proposes inclusive strategy of sourcing Morgage in Nigeria

Mortgage Objective.

To develop an inclusive, data-driven mortgage framework that leverages Nairaandkobo.ng’s economic indicators and digital tools to increase homeownership, access to credit, and market transparency for underserved individual groups across Nigeria.

1. Strategic Foundation

Nairaandkobo.ng, as an economic intelligence and financial education platform, can position its mortgage service as a market integrator—linking data, lenders, developers, and consumers through transparent insights and simplified decision tools.

Key goals:

- Democratize access to mortgage information.

- Bridge the gap between formal lenders and informal income earners.

- Use data analytics to profile creditworthiness and housing demand.

2. Core Service Structure

a. Digital Mortgage Marketplace

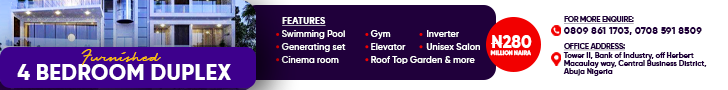

- Integrate a “Mortgage Portal” showcasing real-time rates, locations, payment duration, plot sizes, structure per unit of plot, eligibility calculators, and comparison tools for banks, microfinance, and housing cooperatives.

- Include mortgage simulators (repayment, interest sensitivity, tenure).

b. Alternative Credit Profiling

- Use Nairaandkobo.ng’s indicators (income patterns, savings behavior, and digital payment footprints) to generate a “Mortgage Inclusion Score” for informal workers.

- Partner with fintechs and data aggregators (e.g., credit bureaus, BVN-linked APIs).

c. Micro-Mortgage Products

- Promote low-ticket, short-tenure mortgage models for incremental home construction or off-plan housing.

- Structure products for artisans, small traders, and cooperative members.

d. Mortgage Education & Advisory Hub

- Create multimedia content (videos, explainers, calculators) to teach users about interest rates, loan terms, refinancing, and government housing schemes.

- Host online mortgage clinics and Q&A sessions.

3. Partnership Ecosystem

- Financial Institutions: Collaborate with banks, NMRC, mortgage refinance companies, and microfinance banks for loan disbursement.

- Developers: Partner with estate developers for verified off-plan and rent-to-own listings.

- Government & DFIs: Align with Federal Mortgage Bank, NMRC, and state housing schemes to expand reach and policy backing.

4. Technology & Delivery

- Deploy a mobile-first platform with localized language support.

- Integrate secure digital KYC, document uploads, and loan prequalification.

- Offer an API interface for partner institutions to list products and manage leads.

5. Inclusion & Impact Metrics

To ensure transparency and measurable impact, track:

- % of informal-sector applicants approved.

- Gender and youth participation rate.

- Average processing time and loan disbursement rate.

- Regional mortgage penetration growth (by state/LGA).

6. Policy & Advocacy Role

Nairaandkobo.ng can act as a thought leader by publishing insights on mortgage affordability, regional housing demand, and financing gaps—informing policymakers and investors on where interventions are most needed.

Conclusion

By combining economic intelligence, technology, and partnerships, Nairaandkobo.ng will evolve into a digital housing finance enabler that strengthens mortgage inclusion, supports data-driven lending, and advances Nigeria’s sustainable housing ecosystem.

|

S/N |

STATE /LOCATION |

ESTATES NAME |

ACTUAL PRICE |

100 MONTHS PAYMENT DURATION |

PLOT SIZE |

UNIT PER PLOT |

REMARKS |

PROPERTY DESCRIPTION |

|

ABUJA |

|

|

||||||

|

1 |

Inspection, Picture and Videos, on request, subject to confirmation on availability. |

|

||||||

|

2 |

|

|

||||||

|

3 |

|

|

||||||

|

4 |

|

|

||||||

|

5 |

|

|

||||||

|

6 |

|

|

||||||

|

7 |

|

|

||||||

|

8 |

|

|

||||||

|

9 |

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|

|

14 |

|

|

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

16 |

|

|

|

|

|

|

|

|

|

17 |

|

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

|

|

19 |

|

|