Steel rod prices in Nigeria rise by up to 210% in two years

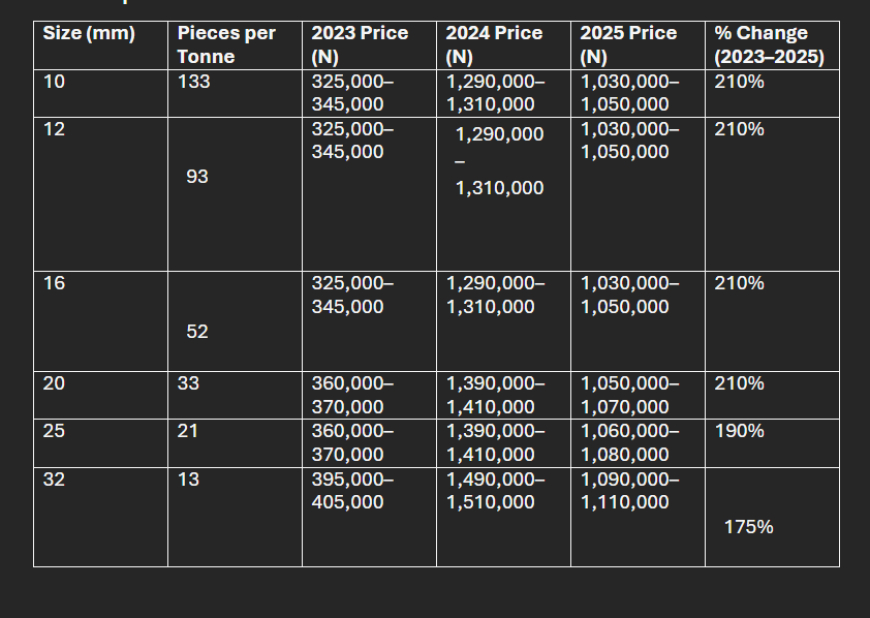

Steel rod prices in Nigeria have surged sharply over the past two years, with smaller sizes such as 10–16mm rods increasing by as much as 210% from 2023 to 2025.

Larger rods, such as 32mm, rose by around 175%, according to a market survey conducted by Nairametrics.

Steel rods are a critical component in building construction, providing reinforcement and structural support that ensures the stability and safety of structures.

They are widely used in columns, beams, slabs, and foundations, where they help distribute loads and prevent structural failure.

The dramatic price increases have forced individuals and companies handling construction projects to spend significantly more on reinforcement, driving up overall project costs and, in some cases, prompting designers and contractors to reconsider building plans to optimize material use.

For example, the price of 10 mm rods jumped from around N335,000 per tonne in 2023 to N1,040,000 in 2025.

Market insights from sellers

Gboyega Adewale, a steel rod seller at Maya Junction in Ikorodu, Lagos, explained to Nairametrics how fluctuations in the exchange rate and import dependency have shaped steel rod prices over the past two years.

- According to him, “the relatively low prices in 2023 reflected a period when the naira was being exchanged for around N500 to the US dollar.”

- He noted that the increase was very steep in 2024. “Prices for smaller rods, such as 10–16mm, soared from around N335,000 per tonne in 2023 to N1.3 million, while larger rods, like the 32mm size, jumped from N400,000 to N1.5 million,” he said.

- Adewale explained that some steel rods are imported into the country, meaning that “the exchange rate directly affects their cost.” The sudden surge forced some people handling construction projects to hold on to their funds and wait to see how the exchange rate would stabilize before committing purchases.

He added that since there has been some stability in 2025, prices have dropped slightly, with 10–16mm rods now selling at N1.04 million per tonne. “I envisage that prices could fall further if the naira maintains this stability,” he said.

Another source, simply identified as Bisi, the owner of a Surulere-based professional supplier of building materials, explained to Nairametrics that “while current prices in 2025 remain much higher than in 2023, demand has picked up again, approaching near-optimal levels as contractors and project managers resume procurement.”

Insights from construction experts

Babatunji Adegoke, a civil engineer, explained to Nairametrics that despite the soaring cost of steel rods, engineers generally maintain their standard usage because they are trained to manage materials efficiently.

He noted that “even with the increasing cost, engineers do not drastically change their usage of steel rods because efficiency is built into our design approach.” In projects with tighter budgets, engineers may be required to use available materials even more carefully, ensuring that every rod is used effectively without compromising the structural safety of the building.

Adegoke added that “while alternatives such as bamboo, fibre composites, and even shells of sea animals exist, steel rods remain the most widely used reinforcement material across Nigeria and globally.”

Architect Uko Akpan also shared his perspective, noting that the sharp spike in steel rod prices in 2024 led many clients to ask whether their building plans could be redesigned to reduce costs.

He explained that designers can optimize material usage by adjusting elements that demand more reinforcement, such as excess structural features, cantilevers, and extrusions, without affecting the integrity of the building.

Akpan said, “It is possible to adjust design elements that require more reinforcement to optimize costs while maintaining structural safety,” adding that “clients often seek advice on redesigning plans during periods of material price surges.”

Macroeconomic factors

The price of steel rods in Nigeria is closely linked to broader macroeconomic conditions, particularly inflation and exchange rate trends.

Nigeria’s inflation rate, which hit a record high of 21.82% in January 2023, contributed to rising costs across the construction sector. Although the headline inflation rate slowed to 18.02% in September 2025, down from 20.12% in August, the high cost of imported materials—such as steel rods—continues to exert pressure on project budgets.

Steel rods, being partly imported, remain sensitive to exchange rate fluctuations. The period of sharp depreciation in 2024 drove prices to record highs, while the relative stability of the naira in 2025 has helped moderate prices slightly. If the currency maintains this stability, there is potential for further reductions in steel rod costs.

Overall, the current stability of the naira is providing a window for construction costs to moderate, but the lingering effects of high inflation and prior exchange rate volatility mean that steel rod prices remain elevated compared to pre-2024 levels.

What this means

The surge in steel rod prices has significant implications for individuals and companies handling construction projects.

- Higher reinforcement costs directly increase overall project expenses, potentially delaying timelines or forcing adjustments to project scope. While engineers and architects can optimize designs to use materials more efficiently, there is a limit to how much cost can be mitigated without affecting structural safety.

- For consumers and contractors, this highlights the importance of planning for material price volatility and considering the broader macroeconomic context—such as inflation and currency stability—when budgeting for construction projects.

The recent moderation in prices provides some relief, but the market remains sensitive to exchange rate fluctuations, meaning project costs could still shift if macroeconomic conditions change.

Steel rod prices in Nigeria rise by up to 210% in two years - Nairametrics