Assessing UBA’s global influence, returns for investors

he United Bank for Africa (UBA’s) corporate, retail and digital footprints spanning the African Continent and beyond makes it not just a trusted bank but a business partner for global success. At 75, UBA has emerged as a financial powerhouse with rising influence, not only in Nigeria but also Africa and beyond. The Group’s results, recently released to the Nigerian Exchange Limited (NGX), showed its gross earnings rose by 110 per cent, from N271.1 billion to N570.2 billion during the 2023 financial year; creating sustainable benefits for savvy investors, writes Assistant Business Editor, COLLINS NWEZE.

It takes hard work and perseverance to stay at the top. The United Bank for Africa (UBA’s) rise to prominence did not just happen. It is fallout of several decades of resilience, strategic innovation and strong corporate governance across all its transactions and service which has deepened its brand essence and global influence.

A key aspect of UBA’s success is its strong balance sheet that has remained consistent. Over the years, the bank has demonstrated sound financial management, risk mitigation and strong capital adequacy ratios, all of which have contributed to its robust financial standing.

At 75, UBA’s balance sheet, which has grown steadily, is now heavily driven by its African operations. In fact, over 50 per cent of its balance sheet is derived from its African subsidiaries—a remarkable milestone that underscores UBA’s deep integration into the economies across the Continent. It enjoys a regional top tier leadership position in 10 countries and a Systemically Important Bank in Nigeria and other countries.

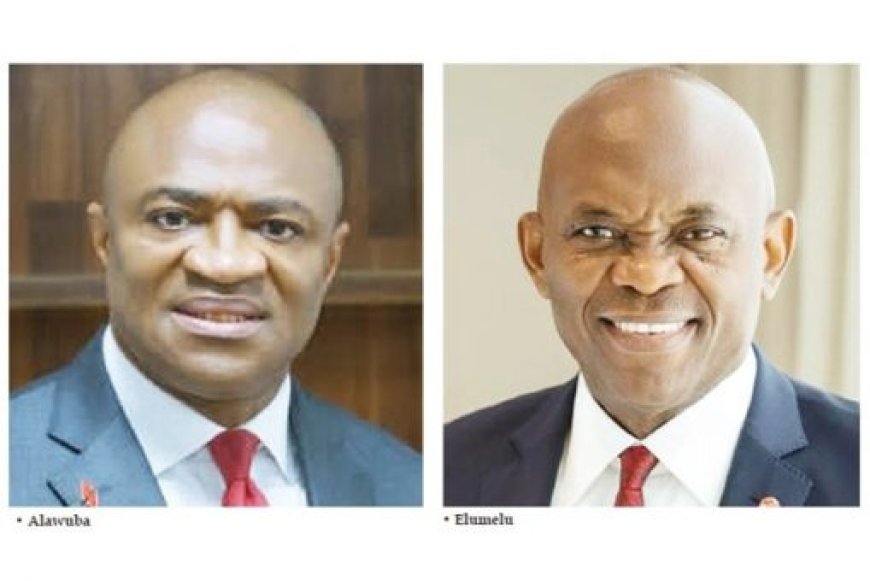

For UBA’s Group Managing Director/CEO, Oliver Alawuba, the bank has, in the course of the years, demonstrated resilience, stability and excellence in serving its customers.

He said UBA strategy has been to support the key sectors driving the economies of countries where it operates and has shown commitment in funding infrastructure, telecoms, agriculture, building roads and expanding sea ports, among others.“In some countries, we have built their capacity for improved revenue generation, to ensure that government generates enough funds to run the economy. Our support for the African economies goes to the critical sectors, depending on the sectors that drive such economies. We are supporting mining, cotton production and cashew, among others. We are committed to developing Africa and key sectors within the Continent. “Our vision is clear: to be the role model for African businesses and connect Africa to the world and the world to Africa,” Alawuba said.

The Group Chairman of the United Bank for Africa (UBA Plc), Mr. Tony Elumelu, said that stakeholders, including government agencies, regulatory bodies and banking institutions must engage in constructive dialogue to foster a collaborative environment.

“By working together, we can build a more resilient banking sector that drives economic growth and supports the aspirations of Nigerians. The success of the Nigerian banking sector is felt beyond Nigeria,” he said, at a conference held in Abuja, recently.

Continuing, Elumelu said: “Nigerian banks have become multinationals, leading the sector across Africa, establishing themselves in the world’s financial capitals–and in doing so; they have changed how our country is perceived, created pathways to opportunities and set themselves up as role models for our other industries.”

He said that the United Bank for Africa Group serves 45 million customers across 20 African countries, as well as the United Kingdom (UK), the United States of America (USA), France, and the United Arab Emirate (UAE).

“UBA Group is not just a bank; it empowers businesses, creates jobs, and facilitates regional and continental trade, contributing to our country’s development.

“At the Tony Elumelu Foundation, we are nurturing a generation of young, empowered African entrepreneurs who are transforming their communities and industries. We leverage our platforms for advocacy, spreading our message of Africapitalism.

“We have seen the results–in the partnerships we have forged, the optimism we leave in our messages and the millions of lives impacted by our business and philanthropic activities,” he said.

Financial results

The UBA Group’s results, recently released to the Nigerian Exchange Limited (NGX), showed that gross earnings rose by 110 per cent, from N271.1 billion to N570.2 billion; interest income surged by 130 per cent, to N440.7 billion while operating income increased by 115 per cent, from N175.7 billion in 2023, to N378.59 billion.

Further consolidating the record performance delivered in the Group’s 2023 Full Year Audited Financials, the UBA, again, saw Profit Before Tax rising significantly by 155 per cent from N61.7 billion in first quarter of 2023, to N156.34 billion in first quarter of 2024; while Profit After Tax jumped from N53.5 billion to N142.5 billion, representing an impressive rise of 165 per cent year-on-year.

This achievement is significant because it highlights UBA’s ability to scale across diverse African markets, each with its own regulatory frameworks and economic challenges. From West Africa to East Africa, UBA has established itself as a bank that understands the local markets while bringing international banking standards to its operations.

On women empowerment, females on board-level positions increased to 47 per cent in 2022 from 31 per cent in 2021; females at the senior management level in Nigeria increased to 33 per cent in 2022 from 23 per cent in 2021 and increased in capacity building on female employees from 40.5 per cent in 2021 to 44 per cent in 2022.

Expansion gains

Furthermore, UBA’s defining feature is its status as the only sub-Saharan African bank with a global presence, operating in Africa, Europe, the Middle East and North America. This international expansion has transformed UBA from a national bank into a global financial institution with millions of customers. Its ability to bridge African economies with global markets allows it to support cross-border trade, remittances and investments that are essential for Africa’s economic development.

Equally, the bank’s strategic global presence means that the UBA can offer seamless services to clients doing business in Africa and other parts of the world, giving it a competitive edge over other African banks. The bank acts as a crucial conduit for facilitating trade, foreign direct investment and cross-border transactions; making it a critical player in the economic integration of Africa with global markets.

It has grown to be a leading financial institution in sub-Saharan Africa, growing into one of the Continent’s most influential banks in the interest of investors and all stakeholders.

The UBA provides corporate, commercial, SME, consumer and personal (retail) banking services to more than 45 million customers, served through diverse channels, including over 1,000 business offices and customer touch points with 2,669 ATMs, 87,223 PoS, and robust online banking services.

Additionally, UBA offers pension custody and related services. The bank has proven expertise and capacity in key sectors of economies across Africa, especially in oil and gas, infrastructure finance, agriculture and commodity/export and this positions it as a preferred partner for structured solutions to key governments and corporate organisations operating in Africa.

The bank not only enjoys well-entrenched risk management and strong corporate governance practices, but also remains the third largest bank by total assets, total deposits and shareholder funds in Nigeria as at December 31, 2022.

The bank is listed on the Premium board of the Nigerian Exchange Robust regulatory understanding and interface led by dynamic management team across geographies. Low cost of risk 0.8 per cent, non-performing loan (NPL) 3.4 per cent and 125.4 per cent NPL coverage. Well-capitalised and compliant under based prudential standards (Capital Adequacy Ratio of 28.3 per cent as at December 2022).

Infrastructure development roles

UBA’s pan-African strategy goes beyond banking; it is deeply interested in the growth and development of African economies. Through its significant contributions to key sectors such as energy, agriculture, infrastructure and education, UBA has positioned itself as a vital partner in driving Africa’s development.

The bank has also played a critical role in financing several large-scale infrastructure projects across Africa, including energy plants, transportation networks and telecommunications infrastructure. These investments have had a multiplier effect, stimulating job creation, enabling industrial growth and fostering economic prosperity.

By financing development in strategic sectors, UBA is helping African countries to build the infrastructure needed to unlock long-term economic growth.

One of UBA’s key strengths is its focus on innovation. The bank is a leader in leveraging digital technology to bring banking services to the doorstep of millions of its customers across the Continent. Its flagship AI-powered virtual assistant, Leo, was the first of its kind in Africa and allows customers to conduct banking transactions via social media platforms such as Facebook and WhatsApp. Leo has revolutionised how customers interact with their bank, providing round-the-clock service, addressing queries and processing transactions with ease.

Moreover, UBA has been at the forefront of mobile banking and digital payment innovations. The bank’s digital banking platforms allow customers to transfer money instantly, pay bills and access loans without visiting a physical branch.

These innovations are crucial to UBA’s mission of financial inclusion, particularly in Africa where vast populations remain unbanked. By offering mobile-based financial services, UBA is opening doors to millions of previously excluded individuals and businesses, contributing to Africa’s digital banking revolution.

UBA’s commitment to financial inclusion goes beyond technology. The bank has been pivotal in promoting access to financial services in underserved and remote areas. With branches in 20 African countries, UBA has created opportunities for millions of Africans to open accounts, secure loans and engage in financial activities that were previously out of reach.

This wide-reaching approach to financial inclusion aligns with UBA’s broader goal of contributing to economic empowerment across the Continent. By making financial services accessible, UBA is supporting small and medium-sized enterprises (SMEs), agriculture and other sectors that are vital to African economies.

Milestones and global recognitions

UBA’s achievements and milestones, over the years, are numerous; further cementing its status as a leader in African banking. The bank has been recognised for its contributions to the African economy, winning multiple awards for innovation, customer service and corporate governance.

One of the most notable milestones is UBA’s inclusion in the Global Systemically Important Banks (G-SIBs) list by the Financial Stability Board (FSB), an international body that monitors and makes recommendations about the global financial system. This listing underscores UBA’s impact on the global stage and its importance to financial stability, in Africa and globally.

UBA has demonstrated resilience and adaptability, particularly during periods of economic difficulty. During the COVID-19 pandemic, the bank was at the forefront of providing relief to affected communities and businesses. UBA contributed to various relief efforts by donating to health authorities and offering financial assistance to its customers to mitigate the economic impact of the pandemic.

UBA’s journey from a Nigerian bank to a pan-African and global financial institution is remarkable. Its ability to balance its African identity with a global outlook has made it one of the most trusted and dynamic banks on the Continent. With a strong balance sheet driven by African operations, a deep commitment to innovation and a focus on financial inclusion, UBA is poised to remain a key driver of economic growth in Africa for decades to come.

Through its operations, UBA has continued to support African economies, bridge international markets and provide groundbreaking financial solutions that will shape the future of banking on the Continent and beyond.

With a focus on sustainability, innovation and inclusiveness, UBA is not only a financial institution but a key enabler of Africa’s long-term growth and global integration.