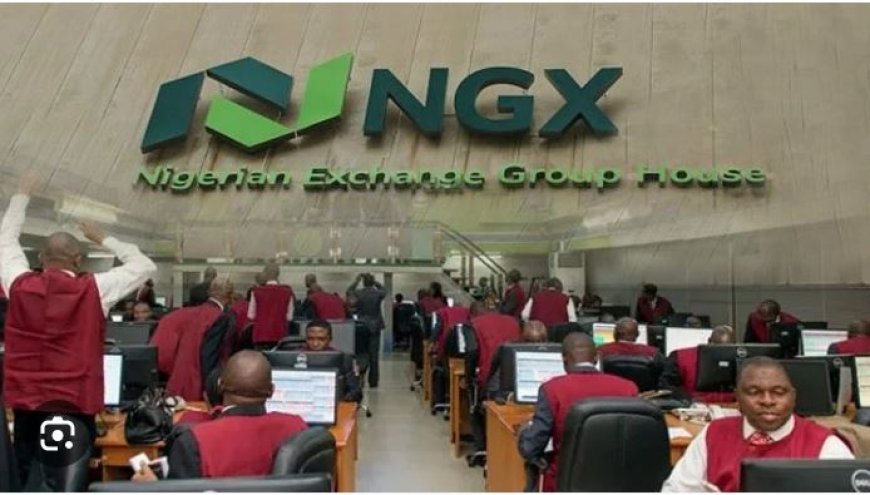

NGX market capitalisation rises by N704.38bn

The Nigerian Exchange opened the week on a positive note as market capitalisation rose by N704.38bn to close at N89.6tn on Monday.

This represents a 0.79 per cent growth compared to N88.92tn recorded at the close of trading on Friday, September 12.

Similarly, the benchmark All-Share Index gained 1,113.31 points, or 0.79 per cent, to settle at 141,659.00 against the 140,545.69 recorded previously. This performance extended the market’s one-week gain to 1.62 per cent, although it reflected a four-week loss of 2.05 per cent. Year-to-date, the ASI has appreciated 37.63 per cent.

Market activity was buoyant as investors traded 555.12m shares worth N24.08bn in 31,566 deals. When compared with Friday’s session, this reflects a 28 per cent improvement in volume, a 49 per cent increase in turnover, and a 33 per cent rise in the number of deals executed.

Livingtrust Mortgage Bank led 32 gainers, appreciating 9.96 per cent to close at N5.08 per share. It was followed by E-Tranzact International, which gained 9.7 per cent to end the day at N16.40, while Regency Alliance Insurance rose 9.64 per cent to N1.82 per share. Northern Nigeria Flour Mills advanced 8.62 per cent to close at N93.90, while Unilever Nigeria gained 8.41 per cent to N72.80 per share.

On the flip side, McNichols led 30 losers, shedding 9.9 per cent to close at N3.55 per share. Honeywell Flour Mill followed with a 9.13 per cent loss at N20.90, UAC of Nigeria dropped 8.01 per cent to N67.15, while Omatek Ventures dipped 7.58 per cent to N1.22 per share.

UAC of Nigeria also emerged as the most actively traded stock, with 67.14m shares valued at N4.49bn. It was trailed by Regency Alliance Insurance with 57.15m shares, Access Holdings with 36.59m shares, and Lasaco Assurance with 31.28m shares.

In terms of value, Geregu Power led with N10.27bn in transactions, followed by UAC of Nigeria with N4.49bn, Zenith Bank with N1.06bn, Access Holdings with N988.76m, and Guaranty Trust Holding Company with N738.53m.

Sectoral performance showed mixed results. The Consumer Goods Index led with a gain of 3.54 per cent, extending its year-to-date return to 90.36 per cent. The Main Board Index rose 1.28 per cent, while the Pension Index improved 0.14 per cent. The Banking Index added 0.05 per cent as Zenith Bank, Access Holdings, and GTCO supported value turnover. However, the Industrial Index closed flat.

Investors on the Nigerian Exchange ended last week on a bullish note as sustained buying interest in large-cap stocks lifted the market. The benchmark All-Share Index appreciated 1.12 per cent to close at 140,545.69 points, while market capitalisation rose by N936bn to settle at N88.92tn.

The rally was buoyed by renewed investor confidence and increased activity across key sectors. According to the NGX weekly market report, all sectoral indices closed positive except the Asem index, which remained flat.

Market turnover for the week stood at 3.19bn shares worth N99.69bn in 132,711 deals, higher than the previous week’s 3.12bn shares valued at N90.30bn traded in 118,018 deals. This reflected growth in volume, value, and number of transactions, underscoring stronger investor participation.

The financial services industry maintained its dominance on the activity chart, accounting for 2.28bn shares valued at N38.81bn in 57,934 deals, representing 71.59 per cent and 38.94 per cent of the total equity turnover volume and value, respectively. The consumer goods industry followed with 198.39m shares worth N12.84bn in 17,508 deals, while the oil and gas industry ranked third with 186.74m shares valued at N35.17bn exchanged in 8,811 deals.