Dangote overtakes importers, captures 62% domestic petrol market

In a major shift for Nigeria’s downstream petroleum sector, the Dangote Petroleum Refinery has outpaced importers to supply approximately 62 per cent of the nation’s Premium Motor Spirit (petrol) in January 2026.

This development, revealed in the latest fact sheet from the Nigerian Midstream and Downstream Petroleum Regulatory Authority, signals a growing reliance on domestic refining capabilities and a potential reduction in the country’s longstanding dependence on fuel imports.

According to the NMDPRA’s State of the Downstream Sector report for January 2026, the total average daily supply of PMS reached 64.9 million litres per day during the month.

Of this volume, receipts from domestic refineries – primarily driven by Dangote, the only petrol-producing refinery at the moment – accounted for 40.1 million litres per day, while imports by Oil Marketing Companies and the Nigerian National Petroleum Company Limited stood at 24.8 million litres per day.

This marks the first time in the 13-month period covered by the report (from January 2025 to January 2026) that domestic production has exceeded imports, flipping a trend where foreign supplies often dominated the market.

The NMDPRA attributed the surge in domestic output directly to “improvement in supply from DPRP”—the Dangote Petroleum Refinery and Petrochemicals—which increased its PMS contributions from 32 million litres per day in December 2025 to 40.1 million litres per day in January 2026.

The 25 per cent month-on-month rise underscored the refinery’s ramp-up in operations, positioning it as the cornerstone of Nigeria’s efforts to achieve fuel self-sufficiency.

The Managing Director/Chief Executive Officer of the Dangote refinery, David Bird, said the refinery now has the capacity to supply more than 50 million litres of petrol daily.

The fact sheet provides a comprehensive monthly breakdown of PMS supply trends, highlighting a volatile but ultimately upward trajectory for domestic refining.

In the early months of 2025, total daily supply hovered between 43.7 million litres in January and 57.1 million litres in May, with domestic refineries contributing a modest 18 to 25 million litres per day, representing about 32 to 47 per cent of the market.

Imports filled the gap, peaking at 38.6 million litres per day in May 2025 as demand pressures mounted.

September 2025 recorded the lowest total supply of 39.7 million litres. Dangote supplied 17.6 million litres daily, while 22.1 million litres were imported each day. The NMDPRA said there was a low petrol supply in September, prompting the granting of licences for importation.

However, a recovery began in October with a total of 46 million litres per day, out of which Dangote supplied just 17.1 million litres daily.

November 2025 recorded huge petrol imports. Total supply jumped to 71.5 million litres per day, driven largely by a surge in imports to 52.1 million litres per day – the highest import volume in the dataset. The Dangote refinery domestically supplied a paltry 19.5 million litres per day in the 11th month.

Dissatisfied, the President of the Dangote Group, Aliko Dangote, accused the former Chief Executive of the NMDPRA, Farouk Ahmed, of economic sabotage, saying he issued “reckless” licences even while his tanks were full.

By December 2025, the Dangote refinery’s influence became evident: domestic supply doubled to 32 million litres per day, pushing the total to a peak of 74.2 million litres per day, even as imports eased slightly to 42.2 million litres per day.

The January 2026 figures cement this progress, with Dangote’s enhanced output reducing import reliance to just 38 per cent of the market.

Over the full period, domestic receipts – encompassing volumes received into coastal depots and trucked out from refineries – averaged around 20 ML/D for most of 2025 before the late-year boost.

The milestone comes at a critical time for Nigeria, Africa’s largest oil producer, which had historically imported 100 per cent of its petrol before the Dangote refinery started petrol production.

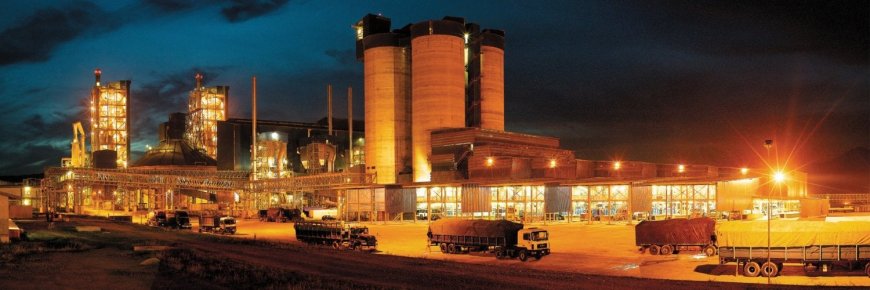

The Dangote refinery, the world’s largest single-train facility with a nameplate capacity of 650,000 barrels per day, began PMS production in September 2024 and has been scaling up amid expectations of full operational stability.

It was observed that the 62 per cent market share achieved in January 2026 could translate to significant foreign exchange savings, reduced exposure to global price volatility, and improved availability for consumers.

Earlier, domestic refineries declared that they had the capacity to supply more fuel into the local market this year than importers did in 2025. The Crude Oil Refiners Association of Nigeria told The PUNCH that its members, including the Dangote refinery, had the capacity to supply all the fuels needed by Nigerians without recourse to importation.

CORAN Publicity Secretary, Eche Idoko, boasted that locally refined petroleum products would surpass imports in the year 2026. “As to whether we have enough capacity to surpass imports, from the report, the Dangote refinery is now doing about 50 million litres a day of PMS. Our consumption at the peak stands at about 54 million litres thereabouts.

“So, there’s just a differential of four million litres. If we go by that. Other modular refineries, if you increase whatever they are producing – I mean, if you give them adequate feedstock – they can increase. Once you give us enough crude oil and you see improvement in refining, we are positioned, we are poised, and we have the capacity. We just need the necessary support in terms of feedstock availability,” Idoko stated.

Dangote refinery captures 62% of Nigeria's petrol market