‘Stop fossil fuel incentives to drive energy transition’

For Nigeria to attract investment in the renewable energy sector that will boost socioeconomic development, and aid transition to renewable energy, the country must remove all tax credits on fossil fuel.

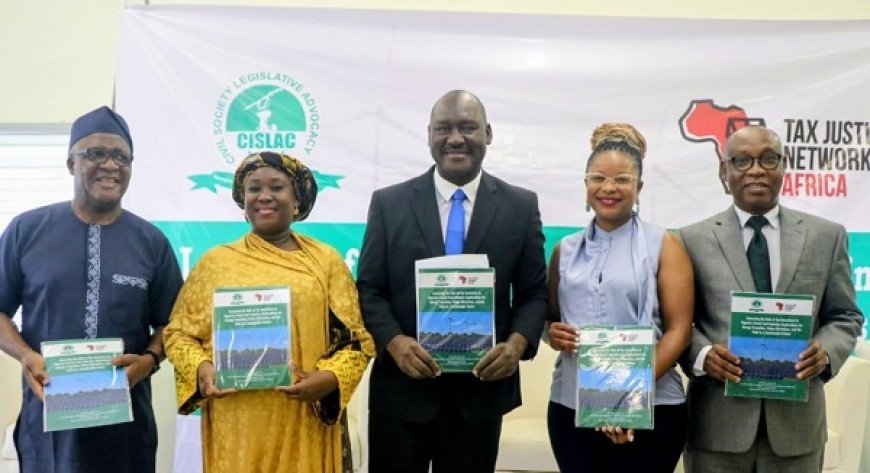

This was the position of the Civil Society Legislative Advocacy Centre (CISLAC), the Nigeria Extractive Industries Transparency Initiatives (NEITI) and other stakeholders at the launch of a report titled “Assessing the Role of Tax Incentives in Nigeria’s Fossil Fuel Industry: Implications for Energy Transition, Policy Direction and the Path to a Sustainable Future” in Abuja, yesterday.

Organised by CISLAC, the forum decried the abuse of the tax incentives in the fossil fuel imdustry, noting how benefitting firms failed to do impactful developmental projects despite the billions they saved from tax holidays.In his welcome address, Executive Director of CISLAC, Auwal Musa Rafsajani, commended Nigeria for showing commitment to reversing the devastating impacts of climate change by establishing institutions such as the Energy Transition Office and adopting the Energy Transition Plan.

He argued that continued incentives for fossil fuel investments contradict the country’s net-zero emission target, noting that expanding investments in oil while providing tax reliefs to fossil operators undermined efforts toward building a sustainable green economy.

The CISLAC boss explained that the report, developed through extensive desk reviews of laws, fiscal instruments, and international policy literature, critically examines how tax incentives sustain the fossil fuel sector and distort energy transition objectives. He said the study situates Nigeria’s approach within the global context, where many countries are phasing out fossil fuel subsidies in favor of renewable energy investments.

Rafsanjani emphasized that the report recommended a recalibration of Nigeria’s fiscal policies to support a just and inclusive energy transition.

The proposed reforms include phasing out fossil fuel tax incentives, improving tax expenditure reporting and accountability, and mobilizing domestic resources to fund renewable energy projects. It also calls for international collaboration in securing climate finance and technical support for economies reliant on fossil fuels.As part of its advocacy, the CISLAC boss urged greater transparency in tax incentive administration, emphasizing that incentives should align with Nigeria’s development and climate goals. Rafsanjani said fiscal reforms must focus on creating an enabling environment for renewable energy investments while ensuring that energy access remains inclusive and equitable for all Nigerians.

He commended the Tax Justice Network Africa (TJNA) and the Energy Transition Funds for supporting the research and advocacy initiative, as well as Professor Sabiu Bariki Sani of the University of Abuja for leading the study. Rafsanjani expressed hope that the report would serve as a valuable policy reference for government and stakeholders in designing fiscal regimes that promote decarbonization, energy inclusion, and sustainable national development.

In his goodwill message, Executive Secretary, Nigeria Extractive Industries Transparency Initiatives (NEITI) Dr. Orji Ogbonnaya Orji, commended CISLAC for its research on the role of tax incentives in Nigeria’s fossil fuel industry, describing it as a timely contribution to the national debate on energy transition and fiscal reform.

He highlighted that Nigeria faces a dual challenge of declining hydrocarbon revenues and inadequate investment in renewable energy, stressing the need for a fiscally smart, socially just, and economically inclusive transition.

Dr. Orji noted that many existing tax incentives in the fossil fuel sector no longer serve national priorities and should be reviewed or removed to support Nigeria’s push for a diversified, low-carbon economy.

“The final draft report of this study which we are currently reviewing as we speak has already alerted the nation that without a well-managed fiscal transition, Nigeria risks facing a dual challenge- declining hydrocarbon revenues and insufficient investment in cleaner energy alternatives.

“The preliminary findings so far point to the possible reality that the path to a low-carbon future must be fiscally smart, socially just, and economically inclusive,” said Orji.

He outlined transparency, fiscal coherence and just transition as three key policy direction the government should look into.

“The real costs of tax incentives and subsidies must be publicly disclosed and justified. Reforms under the new Tax and Revenue Reforms Act should ensure incentives deliver measurable public benefits, and communities and workers reliant on extractives must be supported with alternatives and retraining,” he said.Orji reaffirmed NEITI’s commitment to working with CISLAC and other stakeholders to promote fiscal transparency, climate accountability, and data-driven oversight in achieving a fair and sustainable energy transition.

‘Stop fossil fuel incentives to drive energy transition’ - The Nation Newspaper